The car insurance for teens blog 3126

The smart Trick of How Does Car Insurance Work? - Aami That Nobody is Talking About

In reality, you can save an average of $108 each year by increasing your deductible from $500 to $1,000. For those with tight spending plans, selecting a lower premium and a higher deductible can be a way to ensure you can pay for your vehicle insurance coverage. If you can manage it, paying a greater premium might suggest you do not have to come up with a lot of money to pay a lower deductible in the occasion of an accident.

It is necessary to have your concerns regarding cars and truck insurance coverage deductibles answered before that takes place, so you understand what to expect. Broaden ALLWho pays a deductible in an accident? Do you pay if you're not at fault? When there's a car accident, the at-fault chauffeur is needed to pay the vehicle insurance coverage deductible.

If the at-fault driver does not have insurance or enough insurance to cover the other driver's costs, the no-fault chauffeur can use his cars and truck insurance as secondary protection to pay the expenses. When do you pay a deductible if you are needed? Generally, if you are required to pay a car insurance deductible, the quantity of the deductible will be subtracted from your claim payment when it is provided. insurance.

Basically, the only method to avoid paying a cars and truck insurance coverage deductible is not to submit a claim. While liability protection does not need a deductible, this coverage pays the other chauffeur's costs for injuries and repair work, not your own.

Compare quotes from the top insurance coverage business. Secret Points About Cars And Truck Insurance Coverage Deductibles, If you have vehicle insurance, you will have to pay a car insurance deductible when you submit a claim for repair work and injuries. Just how much you spend for your deductible depends upon your automobile insurance protection and just how much your cars and truck insurance premium is.

The at-fault driver in the accident is normally needed to pay a vehicle insurance deductible. Liability protection does not need a car insurance coverage deductible, but only covers the expenditures of the other chauffeur, not your own. affordable auto insurance. About the Author.

These consisted of vehicle insurance rates by state, insurance provider and vehicle maker, in addition to the motorist's age, driving record, gender (where enabled), amongst other factors. insurance company. This information could assist you estimate just how much your automobile insurance plan might cost based on your location and personal profile, and determine which car insurance providers finest align with your budget and coverage requirements.

Excitement About Which Types Of Car Insurance Do You Need? - Nerdwallet

Having a severe violation like a DUI on your motor car record might increase your car insurance coverage premium by 88% on average. Teen male motorists might pay $807 more for car insurance coverage typically compared to teen female motorists. How much does cars and truck insurance coverage cost by state? Answering, "Just how much does vehicle insurance coverage cost?" is a bit complex, as it varies based upon multiple elements, consisting of the state where you live.

To discover the best cars and truck insurance coverage company for your requirements, get quotes from numerous vehicle insurers to compare rates and features. The table listed below showcases the typical annual and regular monthly premiums for a few of the largest automobile insurance companies in the nation by market share. We've also determined a Bankrate Score on a scale of 0.

Note that your age will not affect your premium if you live in Hawaii or Massachusetts, as state guidelines prohibit auto insurance providers from using age as a ranking aspect. Furthermore, gender effects your premium in a lot of states. Men generally cost more to insure than ladies. This is because men usually participate in riskier driving habits than women and have a higher rate of accident intensity, according to the Insurance coverage Details Institute (Triple-I).

Being associated with an at-fault accident will have a result on your car insurance coverage. The quantity of time it will remain on your driving record depends on the intensity of the accident and state guidelines. As one of the most severe driving events, receiving a DUI conviction typically increases your automobile insurance premium more than an at-fault accident or speeding ticket.

Just how much does cars and truck insurance coverage cost by credit history? Statistically, motorists with poor credit file more claims and have higher claim intensity than drivers with good credit, according to the Triple-I. This indicates that, in general, the better your credit ranking, the lower your premium - cheap car. Your insurance credit tier is determined by each automobile insurance company and is based on numerous aspects; it probably will not precisely match ball games from Experian, Trans, Union or Equifax as it is a credit-based insurance rating, not a credit history.

These shared features can consist of: The high rate tag of these automobiles often come with pricey parts and specialized understanding to repair in the occasion of a claim.

Policyholders who drive fewer miles a year frequently get approved for lower rates (although this mileage classification differs by company). How to discover the very best cars and truck insurance rates, Purchasing vehicle insurance does not need to imply breaking the bank; there are ways to save - cheap auto insurance. Discount rates are one of the very best ways to decrease your premium.

The Best Strategy To Use For How Does Insurance Work In A Car Accident?

Here are some of the most common insurance discount rates in the U.S. Drivers who have no vehicle claims on their record for the previous several years usually receive cost savings. You can frequently minimize your vehicle insurance premium when you bundle your automobile insurance plan with a home insurance coverage or another type of policy offered by your insurer, making discount rates on both policies. If your car is funded or rented, it's most likely that you will have to bring complete coverage on your car., to cover your lorry's damage.

Having this additional protection does suggest that your automobile insurance coverage may be more pricey than if you were just bring the minimum liability limits, but the benefit is that it might decrease your out-of-pocket costs in the occasion of an accident.

Insurers submit brand-new rates with the departments of insurance coverage in the states they serve every year, so your premium may be subject to boosts or decreases that show these new rates. Our base profile drivers own a 2020 Toyota Camry, commute 5 days a week and drive 12,000 miles yearly. Depending on age, motorists may be a tenant or property owner.

Bankrate scores, Bankrate Ratings primarily reflect a weighted rank of industry-standard ratings for financial strength and client experience in addition to analysis of quoted yearly premiums from Quadrant Information Provider, spanning all 50 states and Washington, D.C. We understand it is very important for motorists to be positive their monetary defense covers the likeliest risks, is priced competitively and is provided by a financially-sound business with a history of favorable consumer assistance. laws.

Sorry, we couldn't find any result for - vehicle insurance.

A car insurance coverage deductible is the quantity you accept pay out of pocket for a claim before your policy pays the rest. Keep checking out to read more about automobile insurance coverage deductibles, consisting of: How a vehicle insurance coverage deductible works Some kinds of cars and truck insurance coverage need you to pay a set quantity expense prior to the policy covers the remainder of the claim. car.

See This Report on Liability Car Insurance: Cost And Coverage – Forbes Advisor

The damage is covered under your accident insurance, and the repairs come out to $7,000. If you have a $500 deductible, you pay $500, then your cars and truck insurance company pays the staying $6,500. When do you pay a deductible for automobile insurance coverage? Not all types of car insurance require you to pay a deductible.

An uninsured/underinsured vehicle driver insurance claim might have a deductible, depending on where you live. Automobile liability insurance coverage covers damages and injuries you trigger to other individuals or their residential or commercial property.

Do I pay a deductible if I'm not at fault? If you are in an accident that is not your fault, you typically won't pay a deductible. This is since you 'd be suing versus the at-fault motorist's cars and truck insurance (insurance company). Nevertheless, the procedure of deciding who is at fault may take some time.

You will need to pay your deductible in this instance, however if it's later found that you're not at fault for the accident, you can get a refund. There are a couple of other possibilities that might occur: Your insurance provider might choose to pursue action versus the other motorist's provider to recoup their expenses.

If you are unable to recoup your deductible from your service provider, you can take the other chauffeur to little claims court for the deductible quantity. Bear in mind, nevertheless, that the deductible amount may not worth the time (insurance). Cars and truck insurance coverage deductible vs. exceptional Deductibles and premiums are two types of payments you make to your automobile insurer for coverage.

: payment made over the course of a year for your vehicle insurance protection. cheaper cars. This permits you to submit claims for covered damages when they take place. How high should my deductible be? The higher your automobile insurance deductible, the lower your premium will be. Since your deductible affects your out-of-pocket costs, it's essential to pick an amount that works for your spending plan.

If you have adequate cash to cover a high deductible in case of a claim, you should go that path. This assists keep your yearly premium low and may potentially conserve you a great deal of money in the long run, especially if you do not have to file a claim.

The Definitive Guide to Telematics/usage-based Insurance - Naic

This is due to the fact that the worth of your car might be around what you 'd have to pay of pocket in case of a claim, making a high deductible cost prohibitive. You can typically select from a variety of deductible quantities. There are even some automobile insurance plan without any deductible, however they're so expensive that they're often not worth it (cheap).

Our own research shows that there isn't a substantial impact on your premium once you pass by a $750 deductible, so think about keeping your deductible quantity between $500 and $1,000. It needs to be noted that if you fund or lease your car, you might not have an option in the deductible on your vehicle insurance plan. car.

LLC has actually made every effort to guarantee that the information on this website is appropriate, however we can not ensure that it is complimentary of inaccuracies, mistakes, or omissions. All content and services supplied on or through this website are supplied "as is" and "as available" for usage.

Overview of lorry insurance in the United States of America Vehicle insurance coverage, automobile insurance coverage, or car insurance coverage in the United States and elsewhere, is developed to cover the threat of monetary liability or the loss of an automobile that the owner may deal with if their car is associated with an accident that results in home or physical damage (cheap insurance).

, which provides car owners the choice to publish cash bonds (see below). The insurance premium a motor automobile owner pays is typically figured out by a range of factors including the type of covered car, marital status, credit rating, whether the motorist leas or owns a house, the age and gender of any covered motorists, their driving history, and the area where the automobile is primarily driven and kept.

Insurer offer a motor car owner with an insurance coverage card for the specific protection term, which is to be kept in the vehicle in case of a traffic accident as evidence of insurance coverage. Just recently, states have actually begun passing laws that enable electronic variations of proof of insurance coverage to be accepted by the authorities.

Examine This Report about How Does Car Insurance Work? - The Hartford

Coverage is often viewed as 20/40/15 or 100/300/100. The first two numbers seen are for medical protection. In the 100/300 example, the policy will pay $100,000 per individual approximately $300,000 overall for all people. The last number covers residential or commercial property damage. This home damage can cover the other person's automobile or anything that you hit and damage as an outcome of the mishap.

You can also buy insurance if the other chauffeur does not have insurance coverage or is under guaranteed. A lot of if not all states require drivers to carry mandatory liability insurance protection to ensure that their motorists can cover the expense of damage to other individuals or property in the occasion of an mishap.

https://www.youtube.com/embed/mRxfR2ChqNU

Business insurance coverage for automobiles owned or operated by businesses functions rather similar to personal automobile insurance, with the exception that individual use of the car is not covered. Business insurance pricing is also typically higher than private insurance, due to the expanded types of coverage offered for industrial users - money. (18.

The Greatest Guide To 8 Ways To Lower Your Auto Insurance Premium - Money ...

Vehicle insurance is necessary to protect you economically when behind the wheel. Whether you just have fundamental liability insurance coverage or you have full vehicle coverage, it is very important to guarantee that you're getting the finest offer possible. Wondering how to reduce automobile insurance!.?.!? Here are 15 techniques for minimizing automobile insurance expenses.

Lower vehicle insurance coverage rates might also be offered if you have other insurance coverage policies with the very same business. Car insurance expenses are various for every chauffeur, depending on the state they live in, their option of insurance coverage business and the type of protection they have.

The numbers are fairly close together, suggesting that as you budget for a new cars and truck purchase you might need to include $100 or two monthly for automobile insurance. Note While some things that affect vehicle insurance coverage rates-- such as your driving history-- are within your control others, expenses may also be impacted by things like state guidelines and state mishap rates.

As soon as you understand how much is vehicle insurance for you, you can put some or all of these tactics t work. 1. Make The Most Of Multi-Car Discounts If you get a quote from a vehicle insurance business to insure a single automobile, you might end up with a higher quote per car than if you inquired about guaranteeing numerous motorists or vehicles with that company.

Nevertheless, if your kid's grades are a B average or above or if they rank in the top 20% of the class, you may be able to get a excellent student discount rate on the protection, which normally lasts till your kid turns 25. These discounts can range from as little as 1% to as much as 39%, so make sure to show proof to your insurance representative that your teenager is a great student.

Allstate, for example, offers a 10% car insurance coverage discount and a 25% property owners insurance discount rate when you bundle them together, so inspect to see if such discounts are offered and suitable. Pay Attention on the Road In other words, be a safe driver (car).

Travelers offers safe chauffeur discounts of between 10% and 23%, depending on your driving record. For those unaware, points are normally examined to a motorist for moving offenses, and more points can result in greater insurance premiums (all else being equal). 3. Take a Defensive Driving Course In some cases insurance business will provide a discount rate for those who complete an authorized protective driving course.

The smart Trick of How To Lower Your Home And Auto Insurance Rates - Ksat.com That Nobody is Talking About

Make certain to ask your agent/insurance business about this discount prior to you register for a class. It's important that the effort being expended and the cost of the course translate into a huge sufficient insurance coverage cost savings (cheaper car insurance). It's likewise important that the chauffeur register for an accredited course.

, consider shopping around and acquiring quotes from competing business. Every year or two it most likely makes sense to obtain quotes from other business, just in case there is a lower rate out there.

That's because the insurance provider's creditworthiness must also be considered. After all, what good is a policy if the business doesn't have the wherewithal to pay an insurance coverage claim? To run an examine a particular insurer, think about having a look at a site that rates the monetary strength of insurer. The financial strength of your insurance provider is very important, but what your contract covers is also essential, so make sure you comprehend it.

In basic, the less miles you drive your car per year, the lower your insurance coverage rate is likely to be, so constantly inquire about a business's mileage thresholds. 5. Use Public Transportation When you register for insurance, the business will normally start with a survey. Among the questions it asks may be the variety of miles you drive the insured auto annually.

Find out the precise rates to guarantee the various cars you're thinking about before making a purchase., which is the quantity of cash you would have to pay before insurance selects up the tab in the event of a mishap, theft, or other types of damage to the car.

Improve Your Credit Rating A driver's record is undoubtedly a huge aspect in figuring out automobile insurance coverage costs. It makes sense that a chauffeur who has been in a lot of accidents might cost the insurance coverage company a lot of cash.

Regardless of whether that's real, be conscious that your credit score can be an aspect in figuring insurance coverage premiums, and do your utmost to keep it high.

Indicators on How To Save On Car Insurance: 11 Ways To Lower Your Rate You Should Know

You can check credit reports free of charge at Yearly, Credit, Report. com 9. Consider Location When Estimating Vehicle Insurance Rates It's not likely that you will move to a different state just due to the fact that it has lower vehicle insurance rates. When planning a move, the potential modification in your vehicle insurance rate is something you will want to factor into your budget.

If the worth of the cars and truck is just $1,000 and the collision coverage costs $500 each year, it might not make sense to buy it. vehicle insurance. 11. Get Discounts for Installing Anti-Theft Devices Individuals have the potential to lower their annual premiums if they install anti-theft gadgets. GEICO, for instance, uses a "possible savings" of 25% if you have an anti-theft system in your automobile.

Vehicle alarms and Lo, Jacks are two kinds of gadgets you may want to ask about. If your primary inspiration for setting up an anti-theft device is to reduce your insurance coverage premium, consider whether the expense of adding the device will result in a substantial adequate savings to be worth the trouble and expenditure. money.

Speak with Your Agent It is very important to keep in mind that there may be other expense savings to be had in addition to the ones explained in this short article. That's why it frequently makes sense to ask if there are any special discounts the business uses, such as for military workers or staff members of a certain company.

There are many things you can do to decrease the sting. insurance affordable. These 15 suggestions must get you driving in the right direction.

Listed listed below are other things you can do to decrease your insurance expenses. 1. Search Rates vary from business to company, so it pays to look around (insured car). Get at least three price quotes. You can call companies directly or access information on the Internet. Your state insurance coverage department may also offer comparisons of costs charged by significant insurance providers.

It's essential to choose a company that is economically steady. Get quotes from various types of insurance coverage companies. These agencies have the exact same name as the insurance coverage business.

Unknown Facts About 11 Factors That Affect Car Insurance Rates - Money Crashers

Others do not utilize representatives. car. Contact your state insurance coverage department to discover out whether they supply information on consumer grievances by company. Choose an agent or business representative that takes the time to address your questions.

Prior to you purchase a vehicle, compare insurance coverage expenses Before you buy a brand-new or secondhand vehicle, inspect into insurance expenses. Cars and truck insurance coverage premiums are based in part on the automobile's cost, the cost to repair it, its overall safety record and the possibility of theft.

Evaluation your protection at renewal time to make sure your insurance coverage needs haven't changed. Purchase your house owners and auto coverage from the same insurance provider Lots of insurance providers will give you a break if you buy two or more types of insurance.

Ask about group insurance coverage Some companies provide reductions to motorists who get insurance coverage through a group strategy from their employers, through expert, service and alumni groups or from other associations. car. Ask your company and inquire with groups or clubs you are a member of to see if this is possible.

Look for other discount rates Companies offer discount rates to insurance policy holders who have actually not had any accidents or moving violations for a number of years - car insurance. You might likewise get a discount if you take a defensive driving course. If there is a young motorist on the policy who is an excellent trainee, has taken a chauffeurs education course or is away at college without a car, you might also qualify for a lower rate.

The key to savings is not the discounts, however the final cost. A company that offers couple of discount rates may still have a lower overall price. Federal Person Details Center National Consumers League Cooperative State Research Study, Education, and Extension Service, USDA. cheap auto insurance.

Move all your automobiles to GEICO and see how much more you might conserve.

All About How To Lower Car Insurance For A Teenager - Shopping Guides

Choose A Greater Deductible Normally, the higher your deductible (the portion of your claim you pay out of pocket), the lower your insurance coverage premium. Many individuals prevent having a high deductible because they worry that they would not have the ability to cover it if something occurred. To put your mind at ease, try opening a separate savings account just for emergency situations.

Multiple Automobiles and/or Motorists Might Save Money Whenever you go to your preferred supermarket, you'll generally get a better deal buying multiple loaves of bread instead of simply one. The very same logic applies to cars and truck insurance coverage - liability. Generally, you'll end up with a higher quote to guarantee a single lorry rather than guaranteeing numerous automobiles and/or drivers.

Usually, multiple drivers must live in the same household and be related by blood or marriage. If you have a teen driver, you can expect your insurance coverage rate to increase because teens are a higher liability behind the wheel.

Do not Get Into an Accident It seems like an obvious tip, but it's one that's worth discussing time and time again. Whether you get into a fender bender or severe automobile wreck, accidents have a direct impact on your car insurance rate (car insurance).

https://www.youtube.com/embed/Tfqbk9bc92w

Here are some things you can do to keep yourself and other drivers around you safe: Prevent texting and driving. Make certain to place on the "Do Not Disturb" function whenever you're driving. Don't eat while driving. Comply with traffic laws and speed limits. Do not drive under the impact of drugs or alcohol. low-cost auto insurance.

What Does How To Switch Car Insurance Companies, And Save Money Mean?

This last factor is an important one (insure). If you are obtaining quotes for different plans claim, for a plan with a$3,000 insurance deductible vs. This will make it extremely hard to compare insurers precisely considering that you're not starting from the exact same standard each time.

Prevent this issue by determining ahead of time what deductibles you have the ability to pay. Your insurance deductible should show what you can afford. Undoubtedly, increasing your deductibles will significantly reduce your protection price, however can you manage to do that? If you have a$5,000 deductible, you should be absolutely certain that having to pay$5,000 out of pocket won't put you in financial trouble should you enter a crash. The representative you talk to must do what they can to assist you if you get the feeling they are not acting on part of your finest passions, take into consideration that a red flag. Cost-U-Less provides insurance policy holders with high-grade coverage at some of the lowest prices in The golden state. You can see our web site to acquire an online quote for auto insurance policy. Driving a two-door sports coupe is mosting likely to cost more to guarantee than a more decently valued car with high safety rankings. The reasons for this are simple: things that set you back even more to buy cost more to deal with, and also a fast, showy auto can be a magnet for police officers in addition to an invitation to any person with a hefty foot. If you're buying a used auto, read our article on how to locate the right used automobile. Insurer that have actually developed histories with their customers are most likely to provide reasonable prices to those customers.

If your family members scenario is such that your moms and dads have an automobile insurance policy with a company specifically if they're in good standing with that said company as well as have been with them for several years you need to consider switching to a household strategy to conserve cash (cheaper cars).

low cost prices low cost auto credit

low cost prices low cost auto credit

Cost-U-Less is the location to go if you're looking for less costly automobile insurance in California. Changing Car Insurance Coverage Firms in 6 Steps 1. Swap Out Your Old Insurance ID Cards As soon as your new protection is efficient, you'll want to be certain you have proof of insurance coverage.

Replace your old insurance policy ID cards with your brand-new ones. Is It Poor to Change Automobile Insurer? Changing car insurance provider is okay as long as you're obtaining the insurance coverages you need from your new insurance coverage firm. You'll need to call your current insurer to cancel your plan. Be certain to demand created confirmation of the termination. Can You Cancel Your Auto Insurance Policy Plan any time? Yes, yet depending on your auto's plan, there might be early termination costs. These can vary from around$ 20 to over$200. Often when you switch insurers, you may likewise shed out on offers that can last throughout multiple policy terms. If you see a company providing plans for less than what you presently pay, maintain in mind that this lower rate might raise

significantly the considerably year following you renew. You additionally may not have accessibility to specific benefits you have with your present insurance provider. Exactly How Frequently Can You Change Vehicle Insurance Policy? Unsure where to find the most effective auto insurance!.?. !? You can discover top insurance firms by researching and also comparing quotes from different firms. For instance, if your credit history has actually increased or reduced, your rate will likely transform and you may be able to save by changing. An additional instance of when you may want to take into consideration switching vehicle insurance coverage is when you're getting a new automobile. You'll want to examine to make sure you're covered if your brand-new cars and truck

is completed. For instance, The AARP Auto Insurance Program from The Hartford1 uses offers New Auto Substitute. If your brand-new cars and truck is amounted to, your policy will aid pay to replace it, no matter devaluation. Changing auto insurance provider too usually can trigger you to lose out on advantages that are provided to dedicated consumers.

When you choose that switching cars and truck insurance policy companies might be right for you, follow these actions: Know what you want to change: Before you switch over automobile insurance companies, have a suggestion of what you desire out of a brand-new policy. That said, there are a pair of times when changing your automobile insurance isn't the ideal concept. How is canceling your automobile insurance policy various from switching over vehicle insurance?

vans credit score insure cheaper

vans credit score insure cheaper

Canceling your automobile insurance coverage is various from switching coverage. Or else, you'll be without insurance as well as your document will show a gap in protection. Often Asked Inquiries, Are there any charges for canceling cars and truck insurance coverage? There are no penalties for canceling your cars and truck insurance protection, as long as you don't go without insurance. It's best not to. dui.

terminate an auto insurance plan up until your new policy begins.

Frequently Asked Inquiries, Are there any type of Website link fines for canceling car insurance? There are no charges for terminating your cars and truck insurance coverage, as long as you don't go uninsured. It's finest not to.

The Best Guide To Is It Bad To Switch Auto Insurance Companies? (2022) - The ...

cancel a car insurance policy until plan new policy startsPlan

Terminating your auto insurance policy is various from changing insurance coverage - vans. Otherwise, you'll be uninsured and also your document will show a lapse in coverage. Regularly Asked Questions, Are there any type of fines for terminating car insurance coverage? There are no fines for terminating your automobile insurance policy protection, as long as you do not go without insurance. It's finest not to.

terminate a vehicle insurance plan up until your brand-new policy begins.

Canceling your auto insurance policy is various from switching over protection. Otherwise, you'll be without insurance and also your document will certainly show a gap in coverage. Regularly Asked Concerns, Exist any type of charges for canceling auto insurance? There are no penalties for terminating your auto insurance policy protection, as long as you don't go uninsured. It's best not to. insurance.

cancel a car insurance coverage policy until your new policy begins.

insurers cheaper car low cost insurance companies

insurers cheaper car low cost insurance companies

Often Asked Questions, Are there any kind of penalties for canceling vehicle insurance policy? There are no penalties for canceling your car insurance policy protection, as long as you do not go without insurance. It's ideal not to.

cancel a car insurance cars and truck until plan till policy brand-new.

Terminating your auto insurance coverage is various from switching protection (cheaper cars). Otherwise, you'll be without insurance and your document will certainly show a gap in coverage. Regularly Asked Inquiries, Are there any type of penalties for canceling car insurance? There are no fines for canceling your auto insurance coverage, as long as you don't go uninsured. It's best not to.

terminate a car insurance coverage till your brand-new plan begins.

Often Asked Questions, Are there any type of charges for canceling auto insurance coverage? There are no charges for terminating your cars and truck insurance coverage, as long as you do not go without insurance. It's finest not to.

cancel a car insurance auto until plan new policy brand-new. auto insurance.

Frequently Asked Inquiries, Are there any penalties for canceling car insurance coverage? There are no penalties for terminating your car insurance coverage, as long as you don't go uninsured. It's finest not to.

The Switching Car Insurance With An Open Claim: Will My Prior ... Ideas

https://www.youtube.com/embed/v4Ty-xjyLqEcancel a terminate insurance automobile until plan new policy startsPlan

Not known Incorrect Statements About Vehicle Insurance Requirements - Utah Dmv

insurers cars laws laws

insurers cars laws laws

If you buy from a car dealership, you won't have the ability to drive your lorry off the great deal without the minimal obligation protection insurance if you are paying in full. They'll want you to contend the very least the minimum degree of coverage in order to shield themselves as long as it will shield you (vehicle).

The ideal wager would be to speak to an insurance provider or representative prior to going to purchase your automobile to obtain insurance quotes for the various cars you're interested in getting and also which kinds of coverage you'll call for. The dealership can fax them your freshly bought auto info after the purchase in order to get you insurance coverage (automobile).

Comparing automobile insurance protection supplied from different firms can get you a much better idea of what sort of insurance policy price you'll end up paying. The web content on this website is provided just as a public solution to the web area and does not make up solicitation or arrangement of lawful suggestions.

You need to constantly speak with an appropriately qualified lawyer pertaining to any type of certain lawful issue or issue. cheapest car insurance. The remarks as well as opinions revealed on this website are of the individual writer and also might not reflect the viewpoints of the insurer or any kind of private attorney. Freelance Author Maddie O'Leary is an author at Clearsurance.

The elegance duration you have in between buying and also guaranteeing a previously owned cars and truck might differ by state. If you're asking yourself how long you have to obtain insurance coverage for an utilized car, our group at Val-U-Line is below to inform you.

All About Loss Of Insurance Coverage - Georgia Department Of Revenue

It's finest to allow your insurance coverage business know you purchased one more auto as quickly as possible. That method, they can ensure they're offering you the finest possible prices as well as offering all the protection you require.

Most of the times, all you require to do is call your insurance provider as well as provide them with the year, make, model, and also VIN (vehicle identification number). They may likewise need the purchase price in some states. That will certainly allow them remove your old auto from your policy as well as include your newest vehicle.

state, so you will certainly need to obtain a policy prior to driving home in a made use of auto. The finest action is to call an insurance business or your local representative before going to the dealer. This will certainly give you the chance to contrast quotes from different insurance companies for different secondhand autos.

We will certainly send out all the info over to the insurance company of your selection, so they can set up your new policy. You'll get on the road in no time at all. You will also need insurance policy to register the car. In some states, you'll have an elegance duration of as much as 20 days to obtain a registration, while others will certainly require it prior to you repel from the supplier.

Full insurance coverage consists of liability, as well as the optional thorough and accident coverage. You will require complete insurance coverage if you choose to fund a secondhand automobile.

The 4-Minute Rule for How Long Does It Take To Get Car Insurance? - Creditdonkey

You have to also worry yourself with having evidence of this protection whatsoever times. Currently you might be asking yourself just how you can offer proof of auto insurance after you just acquired a new automobile. Also if you go out and also purchase a brand-new insurance coverage, it might take days prior to that evidence is sent by mail to you.

cheaper auto insurance credit score cheap auto insurance low cost

cheaper auto insurance credit score cheap auto insurance low cost

[resource] If you currently have an auto insurance coverage policy from your previous automobile, you have a grace duration of approximately 45 days to terminate that policy as well as get new insurance coverage or to switch that policy over to your brand-new vehicle. You need to send the updated car insurance policy details to the state of California.

California keeps an eye on any type of time gaps that exist in your insurance coverage - cars. The The Golden State Lorry Financial Responsibility Regulation calls for that car insurance provider send reports to the state concerning any type of gaps in time when chauffeurs fail to have auto insurance policy coverage. This is how the California government recognizes who has insurance coverage as well as who does not.

The majority of people know they need insurance policy for their new automobile, yet in the excitement of purchasing a vehicle they may not investigate it as very carefully as they should. cheaper auto insurance. Avoiding over this detail might create economic problems almost as quickly as you drive off the whole lot. "You require to look for insurance coverage prior to you ever tip foot on the whole lot to work out buying a vehicle," says Dime Gusner, consumer analyst at .

"It can be as short as 1 day or as lengthy as 14 days, so examine prior to you purchase to discover what it is as opposed to assuming you have protection. Also, if you're not replacing a vehicle, then you might not have any type of insurance coverage whatsoever." Not only is the team hectic, it is not its obligation to call and also include a car to your plan.

The How Long Do You Have To Insure A New Car? - Jerry Diaries

Most states need you to have this coverage to pay for problems or injuries to others you may be liable for when driving your auto, claims Gusner. It pays for your clinical costs up to its limits, regardless of fault in an accident.

Autos drop as quickly as you drive off the lot. There are lots of instances of vehicle buyers having their cars completed right after purchase and owing thousands extra than their insurance coverage covers (low-cost auto insurance). "Gap insurance pays the difference between the value of the lorry at the time of its failure and what you still owe on it," claims Gusner.

That's why lienholders call for that you bring it: the vehicle is still the asset of the lienholder, states Gusner. It secures you in instance the auto is harmed by fire, burglary or vandalism - cheaper car insurance.

affordable cheap insurance cheaper cars cars

affordable cheap insurance cheaper cars cars

A fantastic place to begin is by collaborating with your representative to assist you identify the most effective coverage for you and also your brand-new car - automobile.

The process of searching for a brand-new automobile can be stressful at times. You might deal with challenges traveling to different vehicle dealers and attempting to negotiate a fair cost.

The 20-Second Trick For Insuring Your New Car - Encompass

However, each company handles this in a different way, and also the sort of insurance coverage your phone call will certainly have can differ as well. If you do not have an existing policy, you will be required to present evidence of minimal liability protection prior to you can drive your new vehicle on Texas roads. There are no state laws regulating the period within which you can change your existing automobile insurance coverage to a new one.

Each insurance supplier can establish its very own grace period, so ensure to contact your insurance policy agentto find out more concerning your insurance coverage demands and the pertinent moratorium. It is also vital to figure out what coverage is, as well as is not, automatic on a brand-new purchase - car insured. Many insurance policy companies will certainly enable you a moratorium of 7 to thirty days if you are changing your existing protected vehicle for a brand-new automobile.

If you never ever had an auto prior to as well as are purchasing your very first one, you have to have at least the minimal responsibility insurance coverage to be able https://carinsurancewithoutlicen.blob.core.windows.net/$web/index.html to take it out on the roadways. Make sure to call your insurance firm and also enlist in a plan initially, even if you are acquiring your brand-new car from a private vendor.

Bear in mind that you will not be enabled to include anything if you do not currently have existing insurance coverage. insurance company. If you have multiple lorries detailed on your plan, your brand-new car will match the highest degree of insurance coverage for any kind of car on your plan. Your insurance coverage firm will assist you figure out the kinds of protection that you need in your plan.

When trying to find your following vehicle insurance policy plan, count on the Lone Celebrity residents at Reata Insurance policy Team. vans. From San Antonio to Beaumont, Amarillo to Houston, we offer Texas motorists with the quality car insurance they require and are worthy of.

The Best Guide To Insurance Tips: 10 Steps To Buying Car Insurance - Edmunds

When you get a car, you'll need to reveal the dealership evidence of monetary duty before you can take your brand-new trip home. If you already have a policy on one more vehicle, you may not require to obtain a new plan. A lot of insurance plans will cover your brand-new lorry up to the limitations of your current policy for up to 14 days - cheaper cars.

When to acquire insurance policy if you're purchasing your initial automobile If you're getting your very first automobile, it's ideal to get an insurance coverage prior to completing the purchase. While some dealerships will certainly let you acquire a car without proof of insurance, none can permit you to drive it off the lot without showing the vehicle is guaranteed.

Because is expensive, it's typically a lot more economical to include the teenager to an existing policy. If you're leasing or funding an automobile, the loan provider might ask you to acquire insurance coverage with restrictions that are more than your state's minimum. In addition, some leasing agreements consist of a "forced location" stipulation that allows the leasing business to pick and bill for an insurance plan in support of the lessor if they don't give proof of insurance within a defined time structure. insurance affordable.

When you have actually picked a car and also got to a spoken contract with the supplier, call your insurance coverage representative so they can compose a plan and set the effective day as the day you intend to seize your new auto. You'll need to give the automobile's make, design, VIN and also any other information the agent might request.

That's why we recommend including your new car to your plan as well as raising the protection restrictions prior to taking property of the auto. perks. What is brand-new auto insurance policy? The worth of a brand-new lorry typically comes by 10% as quickly as it's repelled the dealership's lot, and it can reduce an additional 20% over the course of the first year.

The Only Guide to Do I Need Insurance Before I Buy A Car? - Direct Auto

New automobile substitute insurance coverage pays to change your brand-new vehicle with one more one of the exact same make and also model, and with the same attributes as well as upgrades. This enhancement to your plan will certainly boost your premium, however it secures you against the decrease in your vehicle's worth - business insurance. Because a vehicle's worth drops one of the most within the initial few years, new vehicle substitute protection might be an excellent option for the very first couple of years you possess the automobile.

Often Asked Inquiries Do I require insurance policy before I acquire a car? While some dealers could allow you get a cars and truck without insurance, it is always best to have insurance policy prior to you buy a cars and truck.

https://www.youtube.com/embed/Z7W1DHE-W-o

It is illegal to drive a cars and truck without insurance coverage, also if you simply purchased the automobile. Do you need insurance policy to examine drive an auto? No. As long as you have a legitimate motorist's license, a lot of car dealerships will permit you to check drive a car if you do not have insurance.

The Ultimate Guide To What Happens To Your Car When The Accident Isn't Your Fault?

Contrast it to the insurance company's record. Work with an appraiser If you believe your insurance policy company is means off the mark with their payout, assume about working with an appraiser.

All material as well as services given on or through this site are provided "as is" and "as offered" for usage. Quote, Wizard. com LLC makes no representations or warranties of any kind of kind, express or suggested, regarding the procedure of this site or to the details, content, materials, or products consisted of on this site.

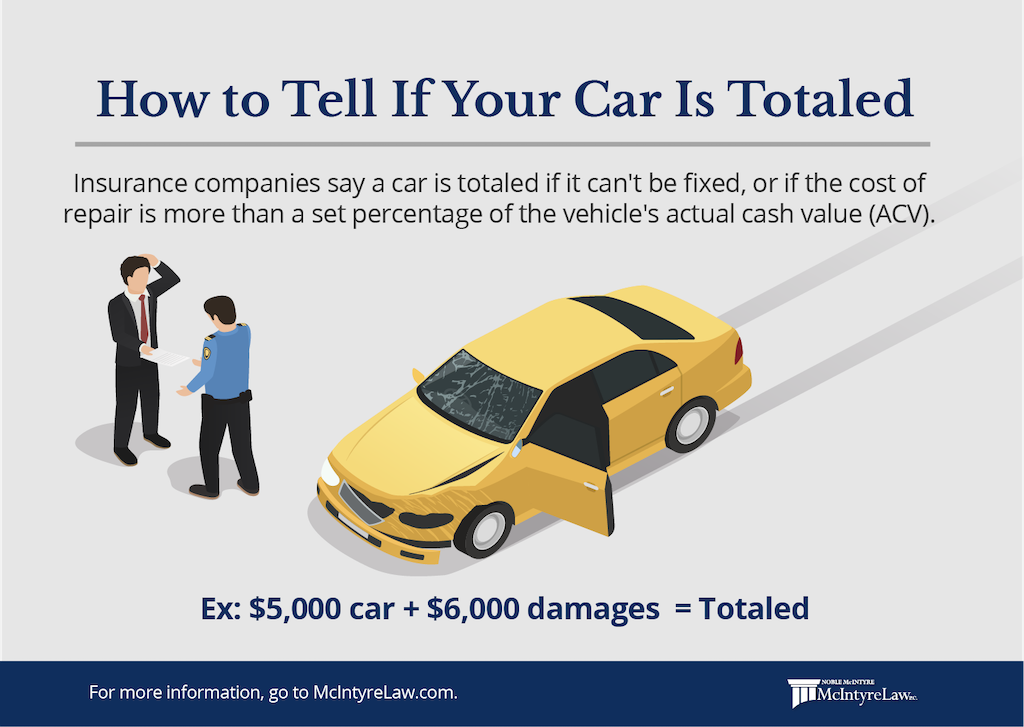

With more than 10 million cars and truck and light truck accidents happening annually, you might need to handle one eventually (trucks). If the accident is poor enough that your car is completed, below is what you need to know and do. Secret Takeaways When an automobile is completed, it suggests the insurance provider believes it isn't worth fixing.

What Is a 'Amounted to' Auto? Depending on your state and also whether you or one more driver were at fault in the mishap, the damages to your car may be covered either by your insurance coverage policy or the other motorist's.

Insurance policy firms have their own solutions for making that determination. The insurance policy firm may call your car a total loss if the price of fixing it goes beyond 80% of its value.

7 Easy Facts About What Happens When An Insurance Company Totals A Car Described

Accident protection is for damages to your vehicle created by an accident with one more vehicle, while comprehensive coverage is for damages caused by something else, such as a fire or fallen tree.

Alternative 1: Let the Insurance Business Pay You The simplest way to take care of a completed car after a mishap might be to simply let the insurer pay you - automobile. Relying on the insurance legislations in your state, this may entail: Changing your totaled automobile with a similar one Using you a money settlement that's comparable to your totaled lorry's actual money value Note that if you think the insurer's deal is also reduced, you can test it.

After your loan has been paid off, any type of staying money is yours to keep. If the insurance coverage business's repayment is less than you owe on the car, you are accountable for paying the difference. Alternative 2: Leave the Vehicle As-Is Sometimes, a completed auto might still be drivable.

This may be something you 'd think about if you don't have accident or extensive protection to pay for repair services. If you decide to keep driving a completed lorry, have it had a look at by an auto mechanic initially to ensure it's risk-free to do so. Choice 3: Maintain the Car for Components One more alternative if your vehicle insurance won't spend for repairs is to keep the cars and truck as well as use it for extra parts.

If not, you might liquidate spare components that are still in good working order to other individuals that have the very same kind of car - trucks. Choice 4: Sell It to a Junkyard If you do not wish to undergo the trouble of selling specific components from a totaled car, you can offer it to a junkyard or salvage lawn rather.

Total-loss Thresholds By State - Carinsurance.com Things To Know Before You Get This

Choice 5: Give Away the Car Contributing an amounted to lorry to a nonprofit organization is another option. cheapest. There are a variety of charities that accept car contributions, including vehicles that have been completed, to support their operations. An added benefit of giving away an amounted to vehicle to charity is that you might have the ability to claim it as a tax deduction.

If your contributed car is sold for even more than $500, you can declare the quantity for which it was sold. To support your tax obligation deduction, be sure to get an invoice revealing the date of your donation as well as the name of the not-for-profit company. Some vehicle dealerships will take a completed vehicle as a trade-in.

Parts for an older car might be more difficult to come by than components for one you acquired a couple of years earlier. It may be worth the added cost if the cars and truck has a greater worth, or you want to hold on to it for nostalgic reasons.

If you assume you may sell the vehicle two years down the line, however it'll take three years to pay off a finance, as an example, it might not be worth it - cheaper.

For instance, state law might need an insurance provider to total a vehicle when the cost to fix it is greater than 75% of the car's ACV. Various other states could set the threshold lower or greater. States without a TLC normally weigh the price to fix and also restore a vehicle versus the automobile's ACV.

The Ultimate Guide To Can I Keep My Car Even If It Was Rendered A Total Loss As A ...

Let's claim you live in a state where legislators established the complete loss threshold at 60%. If your mechanic states fixings will certainly set you back $2,880 or more, the insurer will likely complete your automobile. low cost.

insured car car insurance dui low cost auto

insured car car insurance dui low cost auto

Your Choices After Your Vehicle is Amounted to A complete loss insurance case is generally extra complicated than obtaining a vehicle repaired. Recognizing what to do and also what your options are can help you speed up the insurance coverage case procedure and get the best outcome feasible (cheaper). Five Actions to Take Right After Your Automobile is Totaled A lot of failure crashes are rather major.

When the shock of the crash has passed, you ought to: Failure insurance claims can take a lengthy time to process, so contact your insurance provider and the insurer of any type of other person or entity associated with the mishap as quickly as feasible. For example, if another vehicle driver hit you, contact your insurer and that driver's insurance firm to report the mishap - insurers.

auto affordable cheap auto insurance auto

auto affordable cheap auto insurance auto

The store will offer your insurance adjuster a price quote for repairs and also the insurer will certainly make a decision whether to total the auto. You'll need to give the insurance provider with your auto's title. If you don't have it, you can request a copy from the Department of Motor Autos in your state - suvs.

Assume thoroughly concerning whether it makes monetary sense to keep a totaled car. You'll need to have it fixed, examined, and reinsured to get the vehicle back when traveling. Some people pick to donate their totaled vehicles to philanthropic companies for a tax deduction. You can ask your favorite charity if they function with a vehicle contribution solution or public auction residence - car insurance.

Totaled Vehicle : After An Accident - Questions

What If I Want to Total the Cars And Truck however the Insurance Coverage Firm Does Not? You can ask the insurance coverage company to total your vehicle, however insurance providers ultimately decide whether to amount to an auto based on the cars and truck's market value and the level of the damages.

Typically, a deductible is a collection dollar amount. If the ACV of your completed cars and truck is $5,000 as well as you have a $1,000 insurance deductible, your insurance company will certainly pay out $4,000 ($5,000 - $1,000 deductible). You may not need to pay the insurance deductible if you aren't responsible for the mishap that completed your automobile.

, your liability coverage makes up various other people for their injuries as well as damages to their home. If your automobile was completed in a crash that wasn't entirely your mistake, you can file a third-party insurance claim under responsibility protection with the other chauffeur's or cars and truck proprietor's insurance coverage company.

Comprehensive Coverage Comprehensive insurance coverage covers damage that isn't brought on by an accident with an additional car. If your cars and truck is totaled by a fire, a dropped tree, or severe weather, your thorough insurance coverage protection will likely start. cars. Comprehensive insurance coverage likewise might cover damages triggered by striking a pet while driving depending upon your plan.

If you have a crash with an underinsured or without insurance motorist, you may be able to get payment for your completed vehicle from your uninsured motorist protection (UIM), if you have it - low cost auto. All-time Low Line on That Pays The bottom line is that the various other vehicle driver's or cars and truck proprietor's insurer will pay for your amounted to car if the various other driver was at fault for the accident (negligent).

About Who Pays When Another Driver Has An Accident In Your Car?

How Much Will Insurance Policy Pay for My Completed Cars and truck? The policy limit is the total quantity the insurance company will pay for a single accident or case.

Your cars and truck's AVC is $25,000, yet the at-fault chauffeur has only $10,000 of residential or commercial property liability insurance coverage. That driver's insurance firm will pay only $10,000 towards your overall loss settlement. The only method for you to get the staying $15,000 of your car's ACV would be from your very own accident coverage or underinsured driver protection.

If you have the car, the insurance coverage business will certainly pay you directly. If your auto is funded, the insurance policy company will pay your loan provider.

Timeline for an Overall Loss Negotiation The quantity of time it requires to settle a failure cars and truck mishap instance varies from a couple of weeks to numerous months. The timing depends upon just how rapidly you file your insurance claim, exactly how very easy it is to find out who was at fault for the accident, state laws, as well as whether attorneys are entailed in the settlements. money.

What If I Still Owe Money on a Total Loss Lorry? If the insurer says that your cars and truck is an overall loss, it will just pay you the reasonable market worth of your automobile at the time of your crash, no issue exactly how much cash you owe on your car finance.

How What To Do If Your Car Is Totaled After An Accident - Adam S ... can Save You Time, Stress, and Money.

The actual cash money value of your vehicle is just $12,000. The insurance company is just mosting likely to pay you $12,000, leaving you with a balance of $2,500 to pay on your financing for a vehicle you can no much longer drive. Discover more about what happens when you still owe money on a completed car.

When you're funding a car, you don't possess it, the bank does - cheap insurance. As you pay off your auto loan, you will certainly often owe greater than your automobile is currently worth since of car lending rate of interest and devaluation. Space insurance coverage covers the distinction ("void") between what you still owe on your funded automobile and also the cars and truck's ACV.

As soon as you have actually identified your finance payback quantity and the amount the insurance coverage company means to spend for the loss, you can compute exactly how much cash you will need to take down on your next cars and truck. If you are stuck owing cash for an amounted to cars and truck, your lending institution could be able to combine what you owe right into https://10-min-rule-car-insurance-rates-by-state-2022.ams3.digitaloceanspaces.com/index.html a brand-new vehicle loan - vehicle insurance.

If you have inquiries regarding your legal rights and also alternatives, talk to a vehicle crash attorney. A legal representative can address your questions, work out with insurers, and also represent you in court if necessary. It deserves the expense of hiring a lawyer when you do not really feel the insurer is supplying a reasonable settlement for your totaled car. affordable auto insurance.

cheapest car insurance low cost auto vehicle

cheapest car insurance low cost auto vehicle

You can likewise get in touch with a lawyer straight from this web page absolutely free.

The Ultimate Guide To Can I Keep My Vehicle If The Insurance Company Totals It?

https://www.youtube.com/embed/Un4fNxovAcsIf your cars and truck is declared an overall loss after a crash, you might be questioning your options. Below are response to 3 common inquiries.

The What To Know About Liability Car Insurance - Nerdwallet Ideas

Rental reimbursement pays towards the expenditure of leasing a lorry if you have actually a loss covered by either collision or extensive insurance coverage and also your auto is disabled (car insured).

What is liability insurance coverage? Obligation insurance coverage is the most fundamental insurance protection. The majority of states need that you at least have responsibility coverage, also if your cars and truck is paid for. cheap car. If your cars and truck is not paid for, after that your insurer will require you to have some kind of thorough as well as accident protection also.

It's extremely crucial to ensure that you have the called for kind of insurance when you buy a car, due to the fact that if you do not, the consequences can put a huge damage in your finances. What does obligation insurance cover? While extensive or collision insurance coverage protects you and your residential or commercial property, obligation insurance coverage gives insurance coverage for the various other party if reason a crash.

Bodily injury responsibility insurance policy pays for any injuries that you or an additional motorist of your lorry causes as the result of a mishap. Your bodily injury liability insurance also covers you if you're driving somebody else's cars and truck with their permission (suvs). Building damage liability offers coverage for any type of property damages your car triggers during a mishap.

9 Simple Techniques For Required Auto Coverage - The Idaho Department Of Insurance

Just how do you make an obligation insurance case? If you're in an accident and also just have obligation insurance policy, the various other party or their insurance are the ones that sue against your insurance coverage plan. Called a third-party insurance claim, the insurance coverage business for the individual Browse this site liable will submit the insurance claim, typically after an investigation (cheap auto insurance).

In instances like this, the at-fault party will certainly need to be brought to justice and also demanded problems. Does responsibility insurance policy cover my car if somebody strikes me? Another drawback to having obligation insurance coverage just is that it doesn't cover any type of clinical prices or residential property damages experienced by you. If both vehicle drivers are at fault in a mishap, then the various other driver's insurance policy ought to cover a few of your expenses associated with the crash. prices.

How much obligation insurance policy should you obtain? If your insurance policy is not adequate to cover the damaged party's bodily injury and also building damage prices, they can take you to court to force you to pay.

insurers credit cheap insurance low-cost auto insurance

insurers credit cheap insurance low-cost auto insurance

6/5 rating on the Application Store and made it the leading insurance coverage app in the nation."Prior to Jerry I was paying means also a lot for responsibility insurance coverage.

An Unbiased View of Automobile Insurance Faqs - Aldoi

Client FAQs, Does liability insurance policy cover my cars and truck if somebody strikes me? The other, responsible party's liability insurance will certainly cover the price of fixing your auto. What if somebody hits me and also they do not have liability insurance coverage?

It willgive you 2 original NY State Insurance policy ID Cards (see a sample) or provide you with access to your digital electronic NY State Insurance ID Card send out an electronic notice of insurance policy coverage to the DMV (your insurance policy representative or broker can not submit this notification) Your NY State Insurance Recognition Cards as well as the digital notification of insurance coverage validate your insurance protection. cheaper auto insurance.

Bring one duplicate or kind of your Insurance Recognition Cards with you - low cost auto. The DMV workplace will maintain the paper card. Keep the various other paper card with the lorry as your proof of insurance coverage. Any person running your car needs to have the ability to offer proof of insurance policy while they are operating the car.

Your insurance policy cards need to have the exact same name as the name on your automobile enrollment application. Yes. The DMV will certainly not accept a card if the DMV barcode viewers can not review (scan) the barcode. We will approve out-of-state car insurance protection of any type of kind. If your lorry is signed up in New york city, it should have New york city State vehicle obligation insurance protection.

Liability Car Insurance Definition - Investopedia - The Facts

The 1978 Diplomatic Relations Act and the Foreign Missions Act call for that all Electric motor Autos had and also operated in an U.S. Territory by a member of the Foreign Goal Neighborhood lug obligation insurance policy coverage in any way times - low-cost auto insurance. It is the obligation of all International Missions to give OFM with created proof of continuous insurance coverage.

car vehicle insurance insurance prices

car vehicle insurance insurance prices

A duplicate of an insurance coverage firm's binder, legitimate for at the very least 30 days from the day of application 2. Keep in mind: There are no insurance policy requirements for trailers, which are covered by the insurance coverage plan of the lugging automobile.

As soon as signed up, liability insurance policy should be kept for the signed up Automobile(s) at all times as established forth below. insurers. OFM must be notified each time there is a change, upgrade, revival or termination to the obligation insurance plan. OFM carries out testimonials as well as audits the Foreign Mission Area to ensure compliance.

laws accident suvs vehicle insurance

laws accident suvs vehicle insurance

Participants with Insurance Insurance Coverage: Members of the Foreign Mission Area who have actually signed up Electric motor Car(s) with OFM might currently possess obligation insurance policy coverage that would cover rental Motor Vehicle(s) through their existing policies. Participants of the Foreign Goal Neighborhood need to confirm that their insurance coverage policy covers rented Electric motor Car(s). cheaper car. Members without Insurance Protection: Participants of the Foreign Goal Area that do not have Electric motor Automobile(s) signed up with OFM, and also do not have the mandated minimum level of responsibility insurance policy coverage should obtain such minimum protection prior to the procedure of rental Electric motor Car(s) in any U.S

Obligation automobile insurance coverage is the most effective means to shield on your own versus significant economic loss in the event of a vehicle crash where you're at fault. No one likes to think regarding something like this occurring, however when you're confronted with a severe car crash, the last point you wish to have to bother with is if there will be enough cash or vehicle insurance policy to cover injuries and problems (automobile).

Compare quotes from the leading insurance policy firms. What Is Obligation Auto Insurance Coverage and What Does It Cover?

Texas Liability & Minimum Liability Insurance Coverage for Dummies

If you are struck by someone else, as well as it's their mistake, their liability insurance will cover damages to your car and your clinical bills. There are two types of liability insurance policy: Physical Injury Obligation, Physical injury responsibility covers the vehicle driver and also passengers of the other automobile if you create an at-fault mishap resulting in injuries.

Bodily injury responsibility covers medical bills, discomfort and also suffering and earnings lost by the other individual as a result of not having the ability to work while recuperating from injuries - suvs. Home Damage Obligation, Property damage obligation insurance coverage covers damages to the other individual's residential or commercial property, typically their auto, however it can consist of items inside the lorry.

The last 50 refers to the quantity of home damage liability per mishap, which would certainly additionally be $50,000. Bodily injury obligation is per person, while building damages obligation is per mishap. If you hit three individuals and also 3 cars and trucks in the exact same accident, your insurance will certainly cover you for up to $100,000 for the physical injuries of individuals you strike ($100,000 maximum) and only as much as $50,000 for all 3 of the automobiles.

vehicle insurance vehicle auto insurance credit score

vehicle insurance vehicle auto insurance credit score

Nonetheless, if you include collision and extensive insurance to your policy, you as well as your car will certainly be covered in a mishap if you're at fault. This makes the additional expense of the insurance coverage worth it to the majority of people. Crash will certainly cover damages that takes place from hitting something, and comprehensive covers damages from theft, climate, pets (such as striking a deer) and also vandalism.

Top Guidelines Of What Does Auto Liability Insurance Cover?

insured car insurance companies vehicle car insurance

insured car insurance companies vehicle car insurance

Some states likewise call for uninsured driver insurance coverage (UM), underinsured driver protection (UIM) as well as personal injury defense (PIP). Regardless of your state's needs, you need to have obligation insurance or extremely deep pockets, as it protests the regulation in the majority of states to drive without responsibility coverage. New Hampshire does not need liability insurance policy, however they do need drivers to confirm they have some methods of financial responsibility if they create a crash.

https://www.youtube.com/embed/JYJE3Cu9h0o

You will need to pay for anything that is not covered by obligation insurance, as well as clinical bills can escalate extremely swiftly. Using Your Responsibility Insurance policy, This instance shows exactly how obligation insurance coverage is utilized and just how not having sufficient liability insurance coverage may cause you paying out-of-pocket expenses. credit. Susan is driving residence from work and also hits one more lorry.

Things about Guide To Mexico Auto Insurance And Roadside Assistance

Glass Protection If you live alongside a golf links, you might have located on your own wishing you had glass coverage to spend for the cost of taking care of or changing the windows on your cars and truck. Some insurance provider offer glass protection without insurance deductible, yet the expense of the added protection may surpass the advantages, especially with some policies only covering the windshield.

That makes much even more sense! Whatever you end up doing, there are great deals of ways to save money on automobile insurance policy. And also if you've become aware of something called a "disappearing deductible," no, it's not a magic technique. Your settlements absolutely will not disappear right into thin air. Some insurance business provide going away deductibles at an extra cost for drivers with a long history of safe driving.

If your deductible is $500 as well as you have actually been accident-free for 5 years, your deductible would go to $0. The deductible comes back in full the 2nd you obtain right into a mishap. Ta-da! Factoring in the extra price of the protection, you're generally better off conserving that money to place towards your financial obligation snowball or reserve - perks.

If you avoid of trouble awhile, your premiums will eventually come back down to planet. Another thing that can trigger your premium to rise is if you're frequently submitting insurance claims. So if you have $250 worth of job many thanks to a minor car accident, you could not wish to file that claim.

Examine This Report about Things To Know About Car Insurance And Rental Cars Before ...

Your objective is to find your cars and truck insurance coverage pleasant spot. The ideal method to do this is by functioning with an independent insurance coverage agent that is component of our Backed Regional Service Providers (ELP) program.

Prior to you can lawfully operate a lorry in the majority of states, you must purchase a minimum amount of car insurance policy. Before you can buy a brand-new vehicle insurance coverage policy, you ought to recognize how auto insurance policy functions. affordable auto insurance.

After buying, exactly how does car insurance work? You will certainly require to choose the kind of protection that you require, consisting of policy limits for damage and injuries (insurance). With complete coverage, you will additionally need to choose an insurance deductible, which is the quantity you pay after an accident prior to your insurance coverage action in to assist with your insurance claim.

cheapest cheapest car insurance car cheaper

cheapest cheapest car insurance car cheaper

They will direct you on the following actions. Collect the documentation required to submit your insurance claim. Your insurance coverage specialist can provide you with this details, but it typically consists of a "proof of case" report and a duplicate of the police report. Display your insurance claim progress with the insurance provider and also make sure to follow up with your case professional.

Top Guidelines Of Car Insurance By Lemonade - Protect Your Car, Help The Planet

What enters into insurance prices, Recognizing auto insurance policy rates is essential to conserving cash on your premiums (auto insurance). The average expense of cars and truck insurance is $1,674 annually for full protection, but the expense can differ significantly, relying on the state in which you live. For example, while Louisiana pays one of the most for automobile insurance at $2,724 each year, Maine has the least expensive full insurance coverage price, balancing $965 annually.

How much cars and truck insurance do you require?

dui vehicle insurance affordable car insurance auto insurance

dui vehicle insurance affordable car insurance auto insurance

These include your: Driver's license (both for you as well as for individuals you expect to be driving your insured lorries) Lorry enrollment Social Security number Financial details Vehicle recognition number (VIN) It also aids to have a duplicate of the existing declaration page, as this outlines present insurance policy protection on any kind of automobiles for which you need a brand-new quote - insurers.

Find out concerning kinds of car insurance policy protection with GEICO. What is automobile insurance? Cars and truck insurance assists offer monetary defense for you, your family members, various other passengers, and also your automobile.

The Best Strategy To Use For Understanding Auto Insurance

Looking for car insurance is simple and also fast with GEICO. Find out extra about exactly how automobile insurance coverage rates are figured out. Sorts Of Car Insurance Protection First, let us clarify that there's no such point as "complete coverage." Some individuals might say "complete protection" implies the minimal responsibility protections for their state, detailed coverage as well as crash coverage.

Extra Automobile Insurance Policy Insurance Coverages There's a whole lot to learn more about automobile insurance coverage protections. If you have questions, contact our accredited insurance agents at ( 800) 861-8380. Just how much cars and truck insurance coverage do I require? The correct amount of car insurance policy coverage boils down to your requirements, budget plan, and also state requirements. Some points to bear in mind when selecting your coverage are: Which coverages and limitations does my state need for all vehicle drivers? Does my lienholder have protection needs? Do I require to shield any other properties, such as my house? Just how much can I manage to pay out of pocket at any type of offered time? What is my car worth currently? We advise inspecting your state insurance minimums as well as assessing all protection choices to see to it you have the right insurance coverage.

We encourage you to speak with your insurance coverage representative as well as to read your policy contract to fully comprehend your insurance coverages. insurance companies. * Some discounts, coverages, layaway plan as well as features are not available in all states or all GEICO business. Protection goes through the terms, limits and problems of your plan agreement.

Insurance has actually been simplified with the arrival of new-age digital insurance business. Now, prospective policyholders do not have to depend upon representatives to assist them understand the subtleties of an insurance coverage policy.

Indicators on The Role Of Insurance In A Car Accident Case - Nolo You Need To Know

Falling short to do so will certainly amount to fines. Going by the variety of automobiles when driving as well as the rate of accidents, it is important to make the best option when it pertains to acquiring car insurance protection. Types of Car Insurance in India: Provided listed below are both options when it involves choosing an automobile insurance coverage.

What Is Covered In An Automobile Insurance Policy? Here's the solution to what does automobile insurance cover in India?

As soon as you've identified the most effective means to connect, call your insurance policy company or agent. 3Settle the Claim, Check out the post right here Cooperate with your claims adjuster, the person assigned to manage your claim. See to it to obtain your insurance adjuster's call info as they will certainly supervise of examining the accident and also evaluating the quotes for lorry repair work and insurance claims settlement (insurers).

Lots of elements influence the price of your vehicle insurance. Unlike in health insurance policy, you have to pay a cars and truck insurance coverage deductible for every insurance claim.

An Unbiased View of How Does Car Insurance Work? - The Hartford

What Automobile Insurance Insurance Coverage Do You Need? Each state has its very own legislations that figure out the minimum auto insurance protection requirements that every driver should have.

Keep in mind that a state minimum insurance coverage will only supply baseline security. While this will make certain conformity with state guidelines, it does not figure out just how much protection you need to purchase. A liability-only policy will certainly not cover you and your vehicle in case of a crash, so we highly recommend purchasing additional comprehensive and also accident insurance coverage - cheapest car.

car insurance low cost cheapest auto insurance cheapest auto insurance

car insurance low cost cheapest auto insurance cheapest auto insurance

The actual price of cars and truck insurance policy will certainly differ per person. Insurance coverage service providers utilize specific factors, like area, ZIP code, age, gender, credit report rating, driving history and coverage level to establish costs for each insurance policy holder.

Where Do You Purchase Automobile Insurance Coverage? Prior to choosing an insurance coverage business, you have to determine what you desire in an insurance firm. For the most component, insurance policy service providers supply similar core protections.

The smart Trick of Car Insurance - Canada.ca That Nobody is Talking About

Others may opt for a company offering an equilibrium in worth as well as top quality service (insure). Contrast Insurance Rates, Guarantee you are obtaining the finest price for your insurance.

Discover more Regarding Cars And Truck Insurance Coverage, Vehicle Insurance, Automobile Insurance Coverage, Regarding the Author (cheap auto insurance).

If you're a brand-new vehicle driver, don't be embarrassed to confess that you're not certain just how automobile insurance coverage functions. The concept of vehicle insurance coverage is that all vehicle drivers pay for financial protection.

It will cover, as a minimum, damage triggered by you or your travelers to others. It may also cover your automobile if it is taken or set on fire, in addition to repairs to or replacement of your own lorry. There are 3 primary sorts of cars and truck insurance, which are laid out listed below.

A Beginner's Guide To Car Insurance - Moneygeek.com Fundamentals Explained

cars affordable auto insurance cheaper cars credit score

cars affordable auto insurance cheaper cars credit score